1 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month. Your limit will be displayed to you within the Chime mobile app. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. The good news is that you can still open a free online bank account with no credit check, no monthly fees, or minimum balance requirements.

CheckingExpert has helped thousands of people just like you open online bank accounts. No credit check bank accounts that give you all the checking account features you need and deserve without the exorbitant fees many banks impose. Once you have a checking account, you can pay bills, transfer money, use an ATM and make purchases with a debit card. We offer a variety of checking accounts with options such as online and mobile banking to make it easy to bank when and where you want.

TD Bank offers two different bonuses for new checking account customers. The first is a $300 bonus for a brand new TD Beyond Checking account. New clients qualify for the bonus after making $2,500 in direct deposits within the first 60 days of opening the account. There is no minimum deposit to open the account, but it comes with a hefty $25 monthly fee. This fee is waived if the customer maintains a $2,500 minimum daily balance.

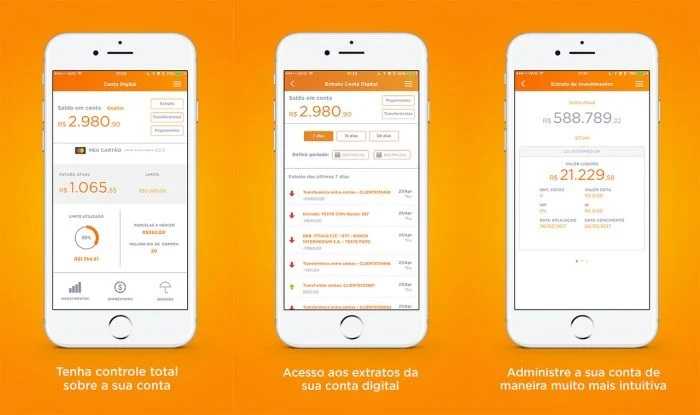

The account pays interest, and there are no charges for non-TD automated teller machine transactions. Chime makes it easy to deposit and transfer your money with its free mobile app. You'll get access to automatic deposits, online transfers, mobile banking, and ATM withdrawals.

This free checking account also comes with online bill pay, direct deposit, and a Visa debit card. It's becoming increasingly difficult to find truly free checking accounts. At many banks, you're now required to pay a monthly maintenance fee for the privilege of keeping your checking account open. Such fees can range from a few dollars to $20 or more, depending on the bank and other associated perks. The Lili Account is a free checking account designed for freelancers, side hustlers, and solo professionals. That's a rare find in a banking industry rife with mediocrity.

A bank account is a special arrangement between you and your bank of choice to deposit and use money. You can decide which type of bank account depending on your personal preferences. Opening a bank account can either be online or at a physical branch. You can get an online bank account with an instant virtual debit card.

A bank account is a special arrangement between you and your bank to deposit and use money. A checking account allows you to access your money 24/7 and comes with a debit card. It is easy to open a bank account online with your phone or computer. You can earn up to 1% cash back on up to $3,000 worth of qualifying debit card purchases per month. The checking account doesn't come with a monthly fee, and you can pair it with a high-interest savings account. Unfortunately, discover only has one brick-and-mortar location, but they do have an extensive ATM network.

The researchers at CheckingExpert.com have selected the top three banks where you can get a bad credit bank account. There are no hidden fees, no minimum balance, and no monthly fees. You can apply online and it takes only a matter of minutes to complete the application process. If you've got bad credit and need a checking account, these banks are two very strong options. Chime is a mobile-first banking app that merges the low cost of online checking and savings accounts with the convenience of truly on-the-go banking.

The headline here is Chime's promise – subject to the policies of payers and their banks – that its Deposit Account customers get paid two days faster with direct deposit. If you're accustomed to Friday paydays but could really use the money on Wednesday, the Chime Deposit Account may be the free checking account you've been waiting for. Chime offers a mobile bank account and debit card without any credit check. Using this service, you will also get your paychecks up to 2 days earlier with a direct deposit.

Varo does not require you to have a minimum balance when opening your bank account. Furthermore, the bank does not charge monthly fees nor overdraft fees for your checking account. Once you open an account with Varo, you will get a free Visa debit card that you can use in over 55 locations for free. Therefore, you can deposit some money at a later date after opening the account. Moreover, the checking account has no minimum balance requirement meaning that you can have any amount in your bank account. Ally Bank Interest Checking Account is another checking account that will give you a debit card when you open an account.

Also, the bank account does not charge any monthly fees. Again, you will not get any bonus when opening your account. However, you can enjoy other features that come with the account. The bank account gives you a 0.15% APY with a $0 minimum balance on your funds, and you can earn substantial amounts of money, especially when you deposit large amounts of money.

Furthermore, the nbkc bank account charges $0 monthly fees. You will be able to deposit checks as well as transact online. A checking account from Capital One 360 comes with no minimum opening deposit and no monthly fees.

In addition, the bank offers mobile banking, mobile direct deposits, online bill pay, and access to 70,000 fee-free ATMs. Varo generally will decline transfers that would overdraw your account, without charging a fee. Once you make a deposit into the account, it will automatically apply to the negative balance to cover that overdraft. Until April 7, 2020, new Huntington Bank customers can qualify for one of two different bonuses after opening up a new checking account. Those who open the Asterisk-Free Checking account may receive a $150 cash bonus.

There is no minimum balance requirement and this account comes with no monthly maintenance fees. For the $200 cash bonus, customers must open the Huntington 5 Interest Checking account. Banks and other financial institutions earn money from many sources. One such source is the revenue they receive from—on-average—over 30 potential fees on checking accounts, according to The Wall Street Journal.

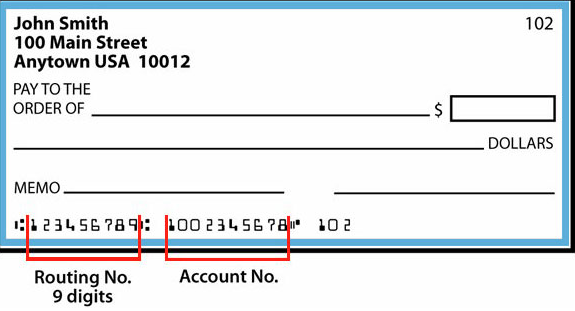

These fees include monthly maintenance, non-sufficient funds charges, overdraft fees, paper statement charges, and dormant account fees among others. However, a cash back promotion can be a win-win for banks and consumers alike, as long as the latter remain aware of the pitfalls that could threaten their deposits. These are payment cards that link to your account and enable you to spend money in your bank account without you having to visit your bank for withdrawals. You can withdraw cash at an ATM point that accepts cards or use the card to purchase goods and services online.

Debit cards also allow you to send money to other bank accounts or mobile wallets online. Marcus offers one of the best high-interest savings accounts currently available. The APY is 2.00%, and there is no minimum opening deposit required. There are also no monthly maintenance fees, and you can apply for a savings account online. In fact, brick-and-mortar banks will charge $20 per month on average for a checking account that earns interest, although at paltry rates.

Online checking accounts, on the other hand, rarely charge a monthly fee and for much better interest rates. Take a look for yourself below, where we compiled the top online checking accounts to give you a head start on finding the best account for your banking needs. Some banks and credit unions offer so-called second chance checking accounts to help people rebuild their credit and financial histories. These accounts usually carry monthly fees and come with a few other requirements, such as participating in a financial literacy or money management class.

An account holder might also not be eligible for overdraft protection, since second chance banking serves as a way to prevent overdrawing an account altogether. You need access to a debit card for purchases or direct deposit from an employer. A bank account is almost the only way to enjoy these basic services. But if you've experienced financial challenges or unexpected events — and the ensuing bad credit — it may be difficult to open a new bank account. Radius Bank is a banking service provider that offers an instant online checking account with bad credit. It also offers a second chance banking account called essential checking.

It allows account holders to upgrade to rewards checking accounts after one year. A checking account is a current account at a bank or credit union that holds money for a short-term period. There are many free online checking accounts with no opening deposit and no credit check at various institutions to keep your money for multiple uses. You do not have to hold large amounts of money in your house or at your workplace since it is not secure. Most online accounts come with little to no minimum balance requirements or monthly maintenance fees.

Of course, you will sacrifice a certain amount of convenience, but it may be worth the trade-off to find a bank account with better terms. Instacash is a 0% APR cash advance service provided by MoneyLion. Your available Instacash advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time.

Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. You may leave an optional tip and pay an optional Turbo Fee for expedited funds delivery. For a $40 Instacash advance with a Turbo Fee of $4.99, your repayment amount will be $44.99. Generally, your scheduled repayment date will be your next direct deposit date.

An Instacash advance is a non-recourse product; you will not be eligible to request a new advance until your outstanding balance is paid. See Membership Agreement andhelp.moneylion.comfor additional terms, conditions and eligibility requirements. 6Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required.

Message and data rates may apply, check with your wireless carrier. Must have a bank account in the U.S. to use Send Money with Zelle®. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. 3Send Money with Zelle® is available for most personal checking and money market accounts.

Must have a bank account in the U.S. to use Send Money with Zelle. Discover Bank has no minimum balance requirements and boasts a pretty forgiving fee schedule with no bill pay, NSF, check reorder, replacement debit card, or bank check fees. Plus, customers have fee-free access to more than 60,000 ATMs around the U.S. – more than most competitors. M1 Spend is free to use and never charges monthly maintenance fees. Spend $125 to upgrade to M1 Plus and get 1.5% APY on all checking balances, 1% cash back on debit card purchases, and up to 4 ATM fee reimbursements per month. Axos Bank is one of the oldest and most trusted digital banks.

This bank offers an instant online checking account for bad credit. It also offers different checking accounts, including a second chance checking account. The Capital One 360 Checking bank account charges a $0 monthly fee when you open an account.

Furthermore, you can get 0.10% APY with a $0 minimum balance. Unfortunately, you will not get any bonus when you open the account. The bank is FDIC insured, meaning that your money will be safe even when the bank collapses. You will have access to your funds via the bank's app that is easy to use.

There are no monthly maintenance fees and no minimum deposit required. In addition, when you open an account, you'll get direct deposit and online transfers to and from other financial institutions. You probably think opening an instant checking account with no deposit means you can forget about features.

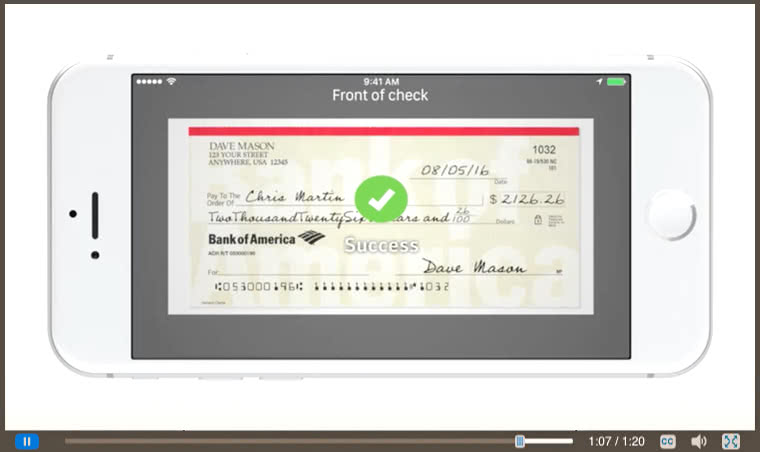

That's what's so neat about a MoneyLion RoarMoney account. There's no minimum deposit requirement and only a $1 administrative fee. Additionally, MoneyLion also offers a free debit MasterCard, free bill pay service, and online banking that lets you manage your finances from anywhere in the world. Additionally, you cannot make cash deposits into this Discover checking account. To make a deposit, you will need to initiate an online transfer, set up direct deposit, use mobile check deposit in the app or mail a check to Discover.

The Consumers CU Rewards Checking account only pays out 4.09% APY on balances up to $10,000. You can earn the addition interest (for a total of 4.09% APY) on balances up to $10,000 if you also spend $1,000 or more using your Consumers Credit Union Visa credit card each month. Your checking account is an important part of your financial picture, and you could be missing out on the best option for your money if you overlook online checking accounts. Online checking accounts are more likely to be free and earn competitive APYs or rewards, all while providing easy access to your money. Brand new HSBC customers can choose from two different checking account offers. The first promises $475 with the opening of an HSBC Premier Checking account.

In order to quality, customers must make direct deposits of at least $5,000 into the account each month for three full months from the second month that the account is open. The second offer is for up to $350 with the Advance Checking account. This bonus is earned over 12 months and requires setting up direct deposit. You'll earn 2% cash back on the amount of your direct deposit each month, up to $30 per month.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.